- Published on

What Got Me into Algorithmic Trading?

- Authors

- Name

- Ang Yi Shuan

Introduction

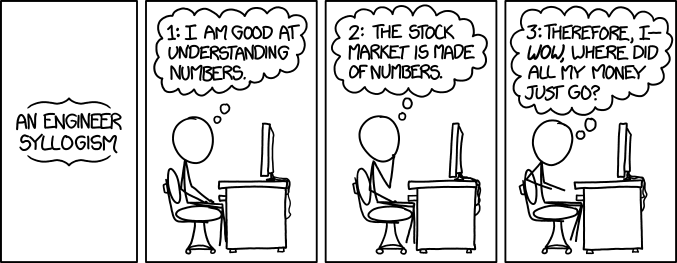

Picture this: me, a novice trader armed with enthusiasm and a few questionable trading strategies, navigating the treacherous waters of the financial markets like a sailor without a compass. Quickly, I learned that I wasn't exactly blessed with the Midas touch; instead of turning trades into gold, I was turning them into fool's gold faster than you could say "buy low, sell high."

Challenges of Traditional Trading

As I reflect on my journey into the world of algorithmic trading, I realize it was a confluence of factors that led me down this path. Initially, my foray into trading was characterized by a series of challenges that made me question my abilities in traditional trading methods.

First and foremost, I quickly came to terms with the fact that I wasn't cut out to be a successful trader in the conventional sense. Like many others, I found myself grappling with emotions such as greed and fear, which often resulted in holding onto losing trades for too long while prematurely exiting winning positions. This lack of discipline, compounded by a dearth of effective risk management strategies, led to substantial financial losses, particularly exacerbated by my experimentation with options trading.

Living in Singapore further exacerbated my trading difficulties, given the significant time zone difference with major markets like the United States. With trading hours overlapping with my sleep schedule, I found it nearly impossible to actively monitor the markets during crucial periods, adding another layer of challenge to my trading endeavors.

Discovery of Algorithmic Trading

However, it was during this tumultuous period that I stumbled upon literature discussing quantitative trading and algorithmic strategies. The concept of employing machines to execute trades on my behalf immediately appealed to me, primarily due to its capacity to eliminate the influence of human emotions from the decision-making process. Additionally, the ability to seamlessly backtest trading strategies offered a level of reassurance and efficiency that was sorely lacking in my previous approach.

As a computer engineer, I possessed the technical acumen to code, but my knowledge of trading and finance was rudimentary at best. Nonetheless, I recognized that possessing the tools alone was insufficient; one must also understand how to wield them effectively. This realization prompted me to delve deeper into the intricacies of trading and finance, thereby equipping myself with the requisite knowledge to leverage algorithmic trading tools effectively.

Advantages of Algorithmic Trading

Moreover, algorithmic trading offers several inherent advantages over traditional methods. Beyond emotionless execution and rigorous backtesting capabilities, algorithmic strategies can exploit market inefficiencies with greater precision and speed, enabling traders to capitalize on fleeting opportunities that may elude manual traders. Furthermore, the scalability of algorithmic systems allows for the simultaneous management of multiple strategies and assets, thereby diversifying risk and enhancing overall portfolio performance.

Conclusion

In conclusion, my transition into algorithmic trading was spurred by a combination of personal challenges, technological curiosity, and a desire for more efficient and disciplined trading practices. While the journey has been fraught with its own set of challenges and learning curves, the benefits of algorithmic trading have far outweighed its traditional counterparts, paving the way for a more systematic and successful approach to navigating the financial markets.

Learn about my 28-month foray into the development of my algotrading system TailTitanPro here.