- Published on

(Short version) Introducing TailTitanPro: Reflections from 28 Months of Building an Algo Trading System

- Authors

- Name

- Ang Yi Shuan

TailTitanPro Logo.

Note: This is the shortened article about TailTitanPro. Want the original (verbose) version? Click here

Legal disclaimer here.

Project Overview

Objectives and Goals

TailTitanPro, an algorithmic trading system, was conceived with a clear goal in mind: to exploit opportunities in the stock options market, particularly in the realm of long calls and puts, known for their limited risk and unlimited profit potential. The system focuses on day trading to mitigate overnight risks and targets weekly options for equities and daily options for indexes and ETFs, where the potential for significant gains is often found.

Motivation

The project stemmed from the realization that manual trading of options, given the sheer volume and variety of tradable contracts, was inherently limited. Algos, with their speed and efficiency, presented an opportunity to monitor and execute trades across multiple tickers and strike prices simultaneously. Moreover, the intellectual challenge of developing an algorithmic trading infrastructure and strategies was inherently motivating, driving the project forward.

Development Process

Architecture

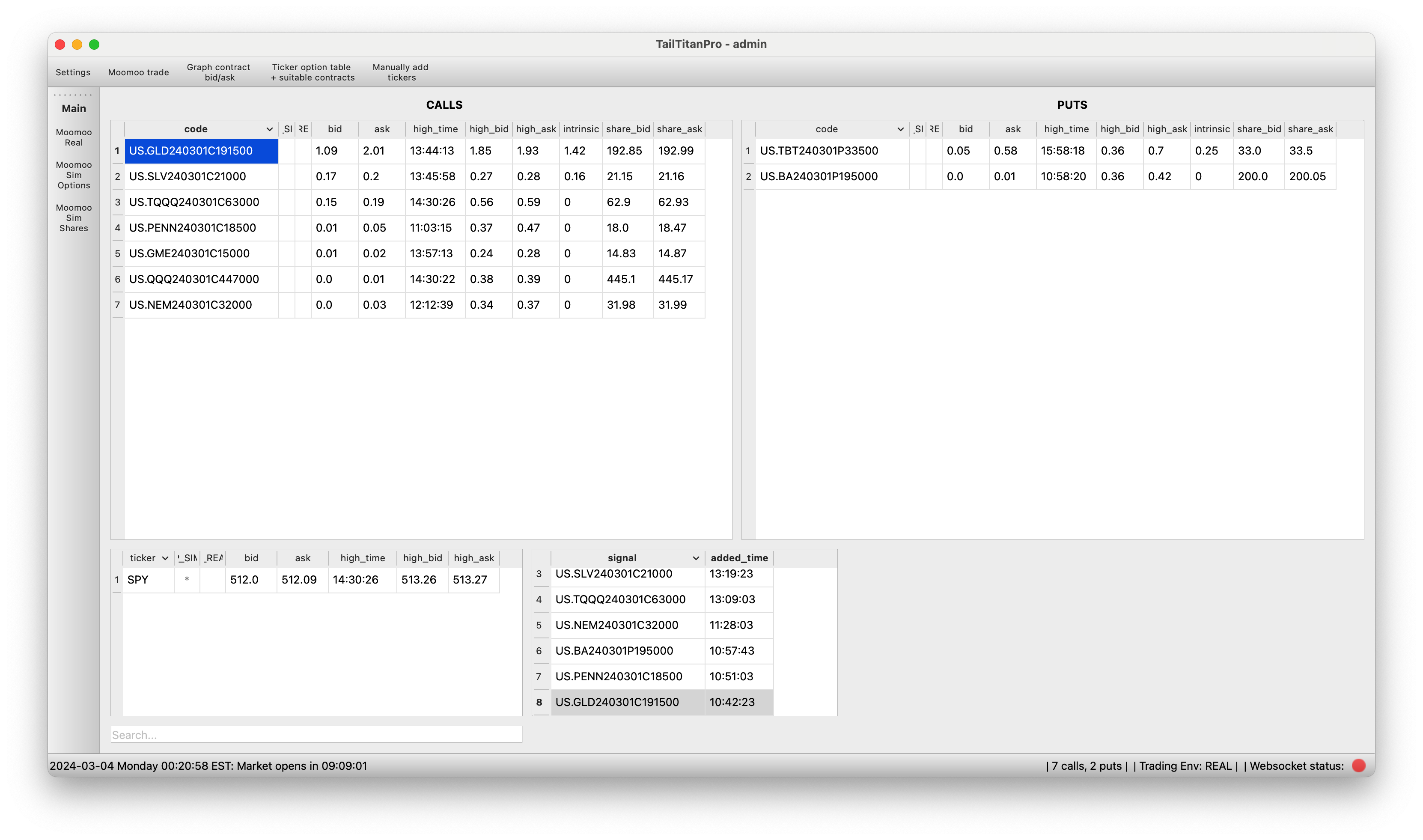

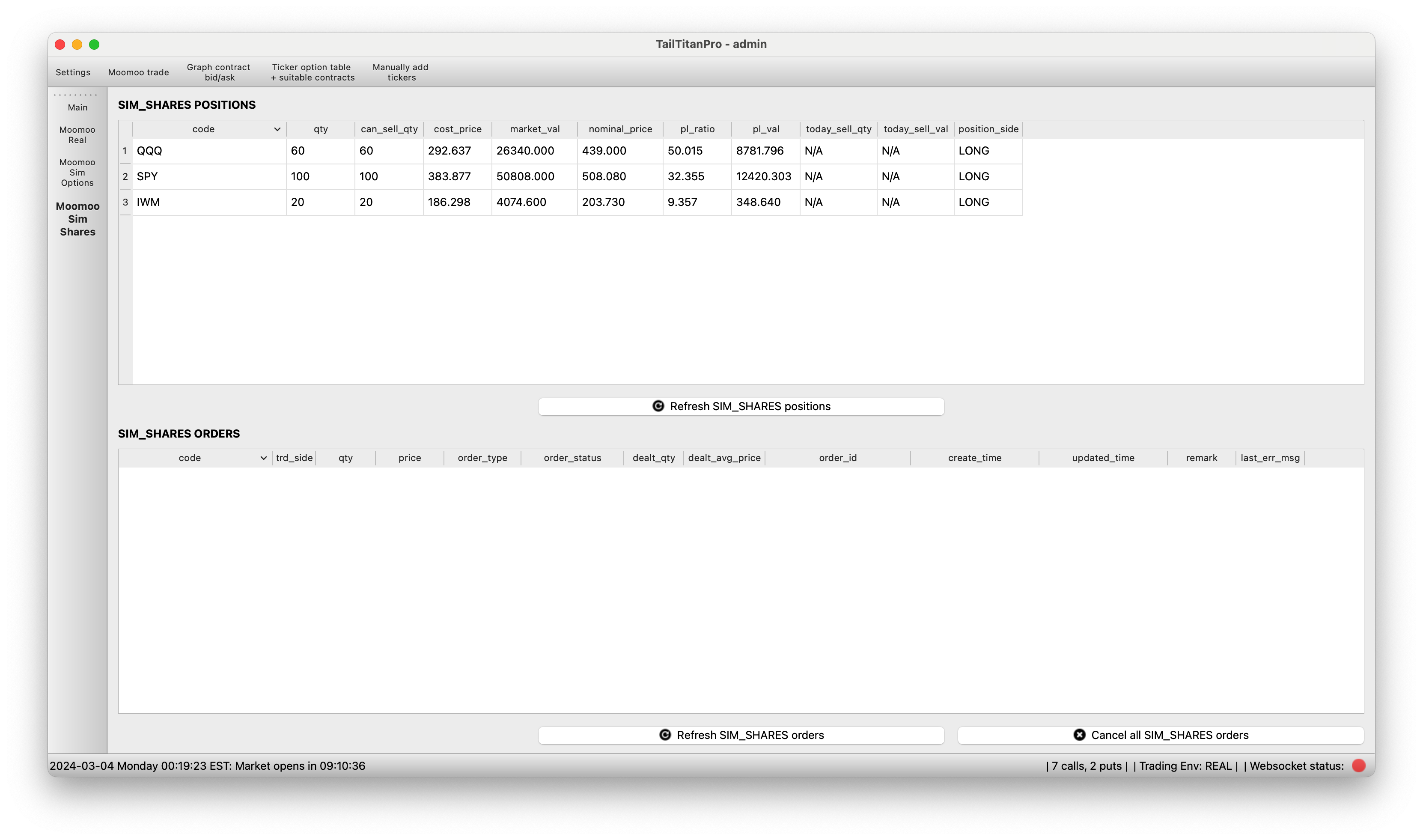

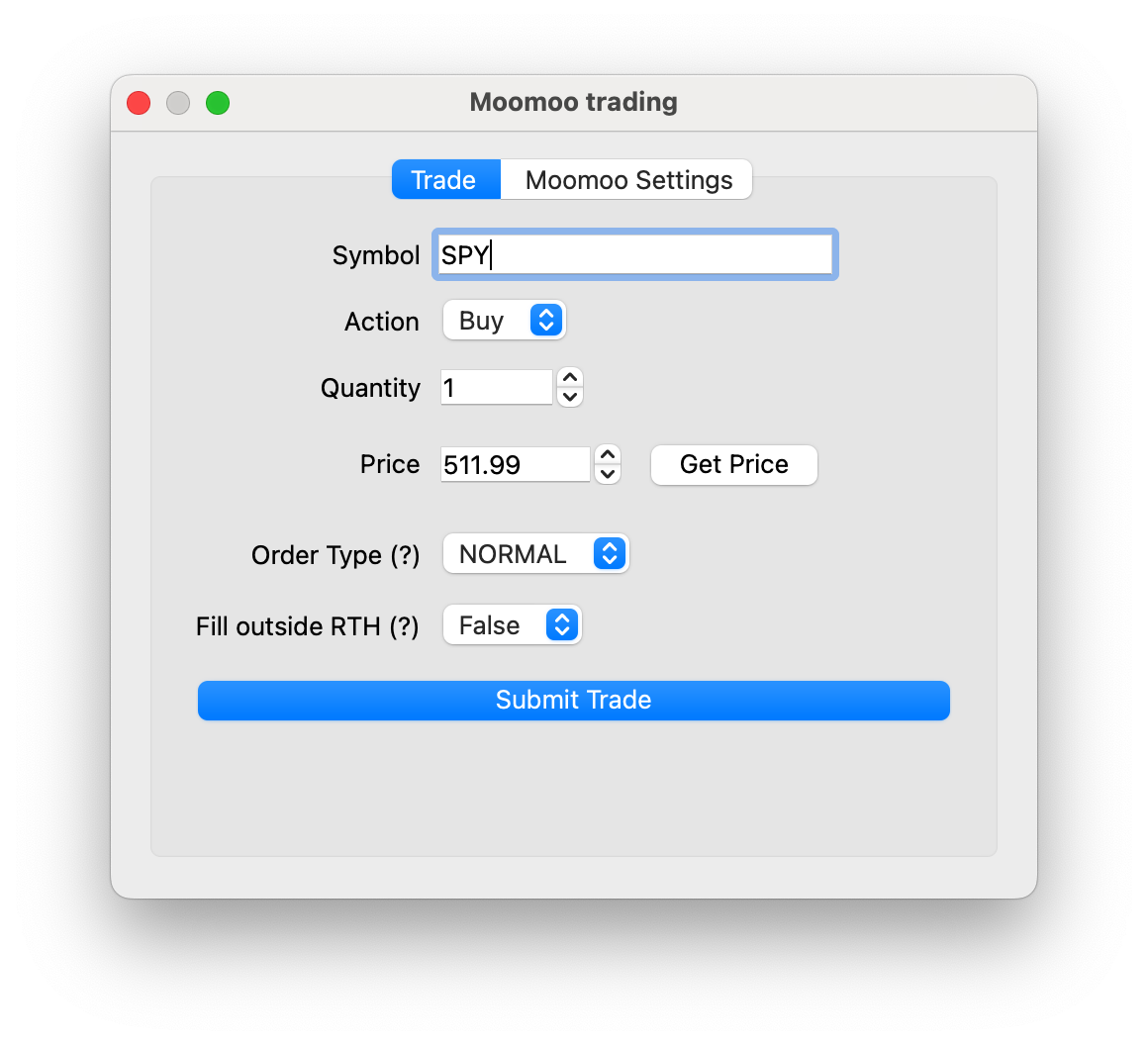

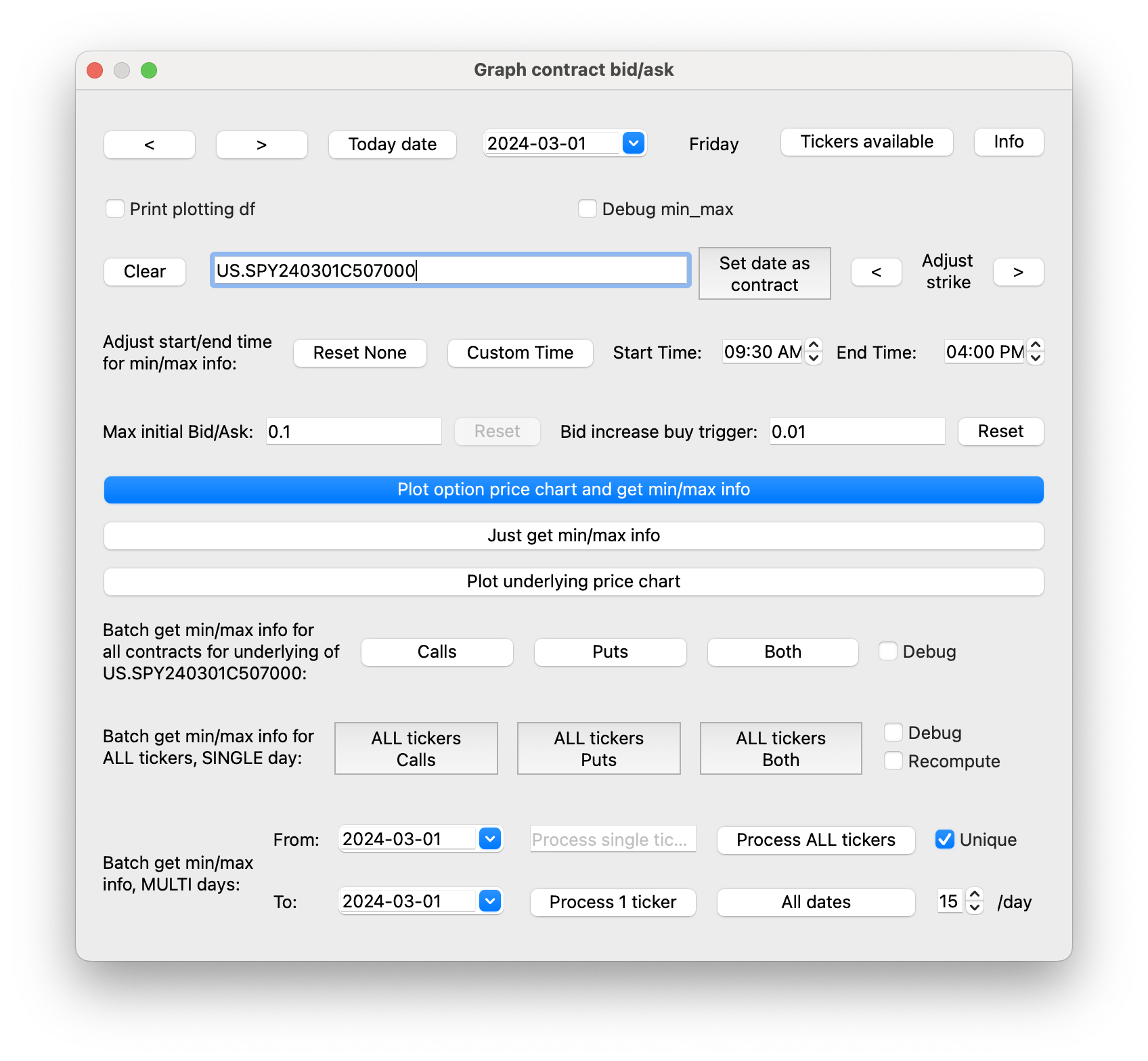

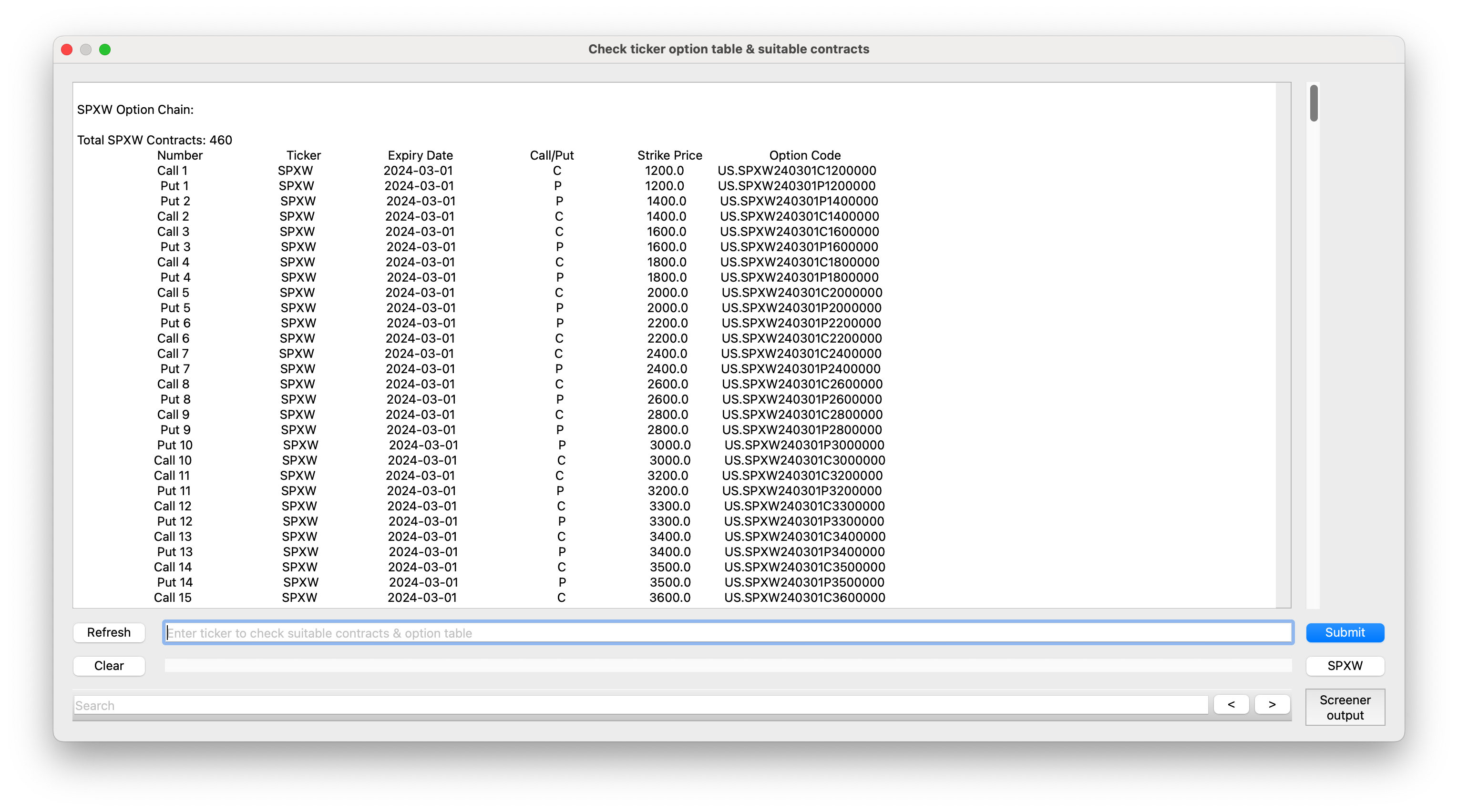

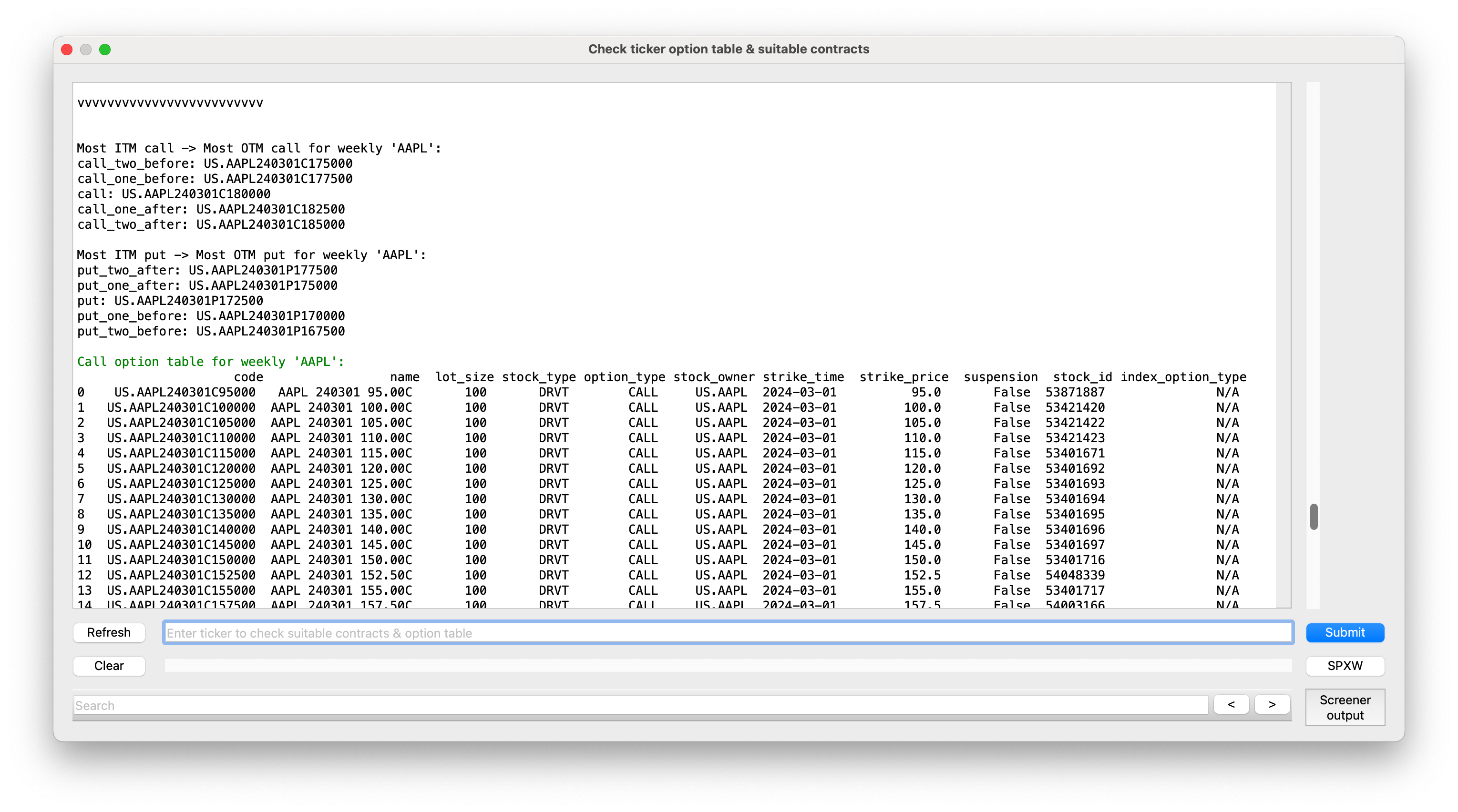

TailTitanPro comprises several components, including a GUI developed using PyQt6. The main page displays various tickers segregated by stocks, calls, and puts, alongside real-time quote data and streaming bid/ask prices. Additionally, the system features pages dedicated to tracking positions, auxiliary functions such as manual trading, and tools for data analysis and visualization.

TailTitanPro Check Option Chain Window - SPXW 0DTE option chain is displayed here. Click the image to expand.

TailTitanPro Check Option Chain Window - AAPL weeklies option chain is displayed here. Click the image to expand.

Technologies Used

The entire system was developed in Python, leveraging libraries such as PyQt6 for the GUI, matplotlib and plotly for charting, and pandas and numpy for data manipulation. The decision to build from scratch was deliberate, allowing for maximum customization and control over the system's architecture and functionality.

Data Collection and Preprocessing

Live option data is sourced from the broker Moomoo, while real-time stock data is provided by Tradier and Finnhub. Historical data is fetched from barchart.com and Alpha Vantage. Data storage is managed using simple Excel files, with caching implemented to optimize data retrieval speed.

Integration and Practical Applications

Real-world Implementation

TailTitanPro has been live since mid-January 2024, trading OTM 0DTE index options. A small amount of capital has been allocated to verify the system's capabilities before considering further scaling. The system's potential applications extend to financial institutions, hedge funds, and proprietary trading firms seeking to optimize trading strategies in fast-paced markets.

Risks and Considerations

While the system has shown promising results during backtesting, transitioning to live trading presents various risks, including capital losses, execution errors, market dynamics, and regulatory compliance. These factors necessitate careful monitoring, risk management, and adaptation to ensure the system's viability and profitability in dynamic market conditions.

Lessons Learned and Future Directions

Key Takeaways

The project has underscored the importance of balance across quantitative modeling, software development, and operational considerations in algorithmic trading. Simplifying strategies, avoiding overfitting, and prioritizing robustness and scalability have emerged as critical lessons. Additionally, the journey has highlighted the need for continuous learning and adaptation in response to evolving market dynamics.

Future Enhancements

Areas for improvement include refining risk management protocols, exploring alternative strategies, and enhancing adaptability to changing market conditions. Continuous innovation and refinement will be key to maintaining the system's relevance and effectiveness over time.

Conclusion and Call to Action

Message to Potential Employers or Collaborators

TailTitanPro represents a significant milestone in my journey as a developer and quant enthusiast. While the system showcases technical skills and innovation, it is also a humble acknowledgment of the complexities and risks inherent in algorithmic trading. I invite potential employers or collaborators to engage in further discussion or collaboration, leveraging our shared passion for quantitative finance and algorithmic trading.

Call to Action

If you're interested in exploring potential collaborations, discussing ideas, or sharing experiences in algorithmic trading, please don't hesitate to reach out. Together, we can navigate the complexities of quantitative finance and strive towards innovative solutions while remaining humble and mindful of the challenges ahead.

Congrats on making it to the end! Want to read the original (verbose) version? Click here